National Positions was published on Forbes with one of the most important articles for e-commerce brands for the holiday season. You can check out the original article here.

——–

Every year, we are asked the same question by multiple clients: Is it too early to start marketing for the holidays? While this question usually starts hitting my inbox in September or October, this year is a bit unique.

Between a lackluster stock market, inflation and an overall unease regarding the state of the economy, businesses are preparing and consumers are considering their holiday spending earlier than ever.

Does this mean you should start blasting out holiday ads now? Well, no. However, planning for a highly competitive season should start now. This way, e-commerce brands can prepare their plans A, B and C as the second half of the year ticks closer and closer to the holiday buying rush.

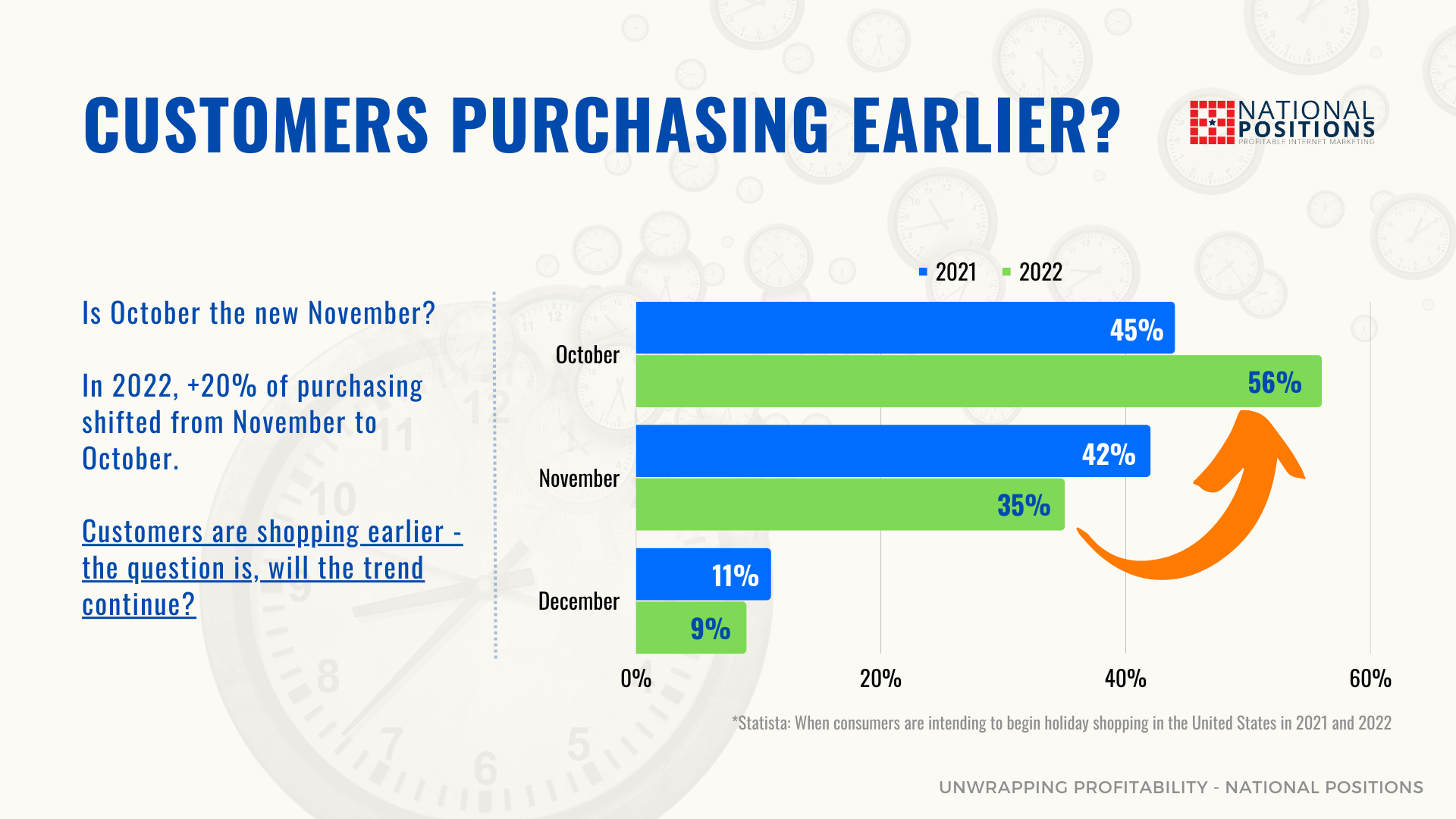

Customers Are Purchasing Earlier Than Ever

In 2022, a reported 56% of customers started their purchasing for the holidays in October, followed by an additional 35% in November. While this might not seem surprising, what is interesting is comparing the numbers from 2021, where October purchasing accounted for 45% and November raked in another 42% of customers.

This means that around 11% of the customers who were making their purchases in November in 2021 shifted their purchase activity to October in 2022. Customers are purchasing those holiday deals earlier year after year.

Granted, in 2022 there were worldwide issues with supply chains and delayed deliveries, so this could have been a driver in the early buying, but I still believe this behavior will carry over into 2023.

Early Buying = Early Researching

According to Google, “36% of consumers said they spent more time researching online before purchasing this year compared to previous years.” This means that those 56% of customers making purchases in October of 2022 were likely researching where their gift-giving dollars were going to go long before they threw down their credit cards.

Just how early are customers going to start searching for those perfect gifts (if they haven’t already)? Exact numbers are hard to come by. That said, it is safe to say that a higher price tag equates to a longer consideration time before the purchase is made.

Customers may start with a Google search, then a YouTube review, some scrolling on social media, back to Google, then over to Amazon, etc.

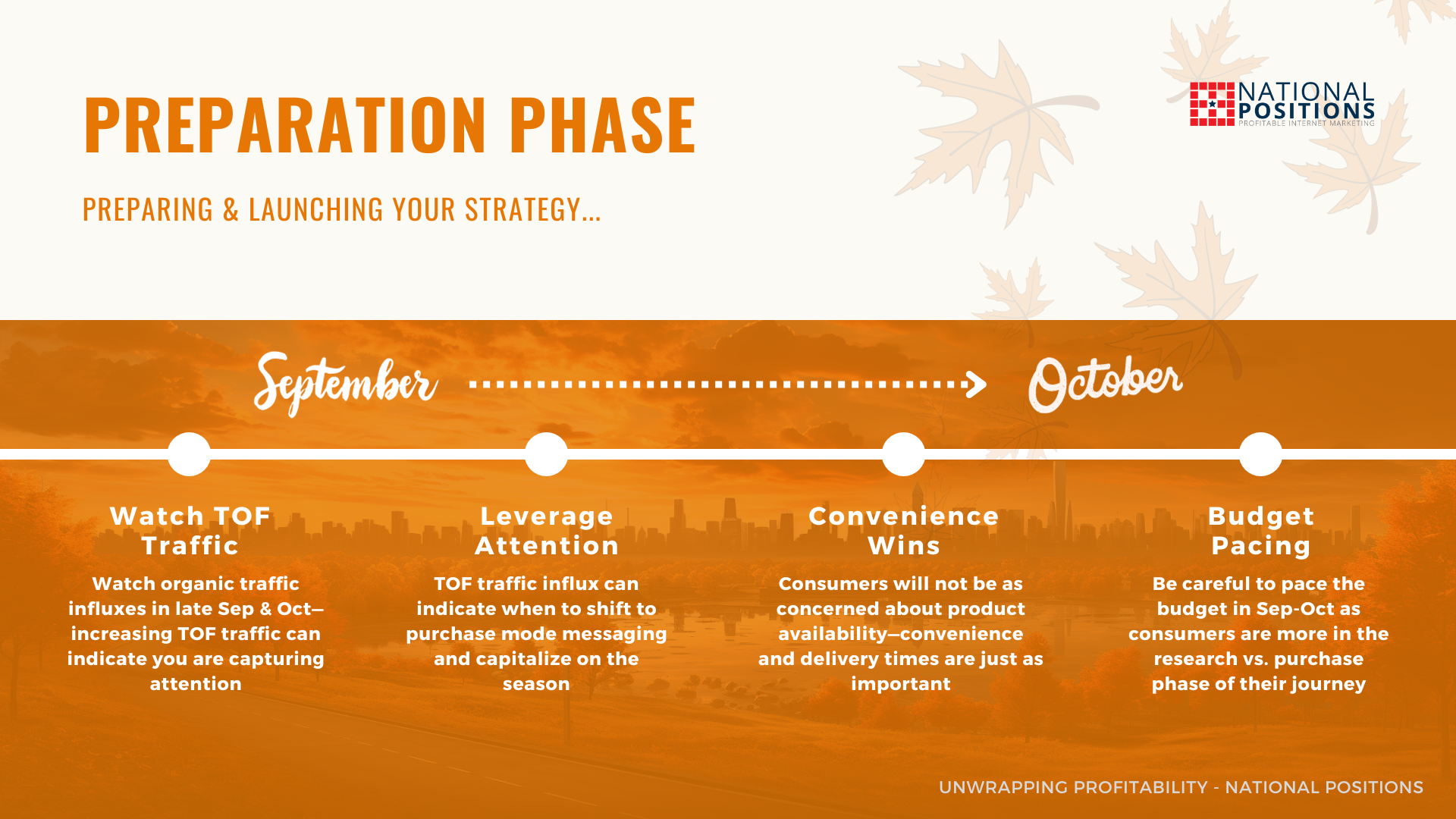

The customer journey can be quite long. So retailers need to be prepared to launch a good 30 days prior to purchasing, which also means that campaigns need to be prepared and in place roughly 30 days before that.

When customers are researching earlier, our clients’ marketing strategies need to be locked down even earlier.

Evaporating Disposable Income

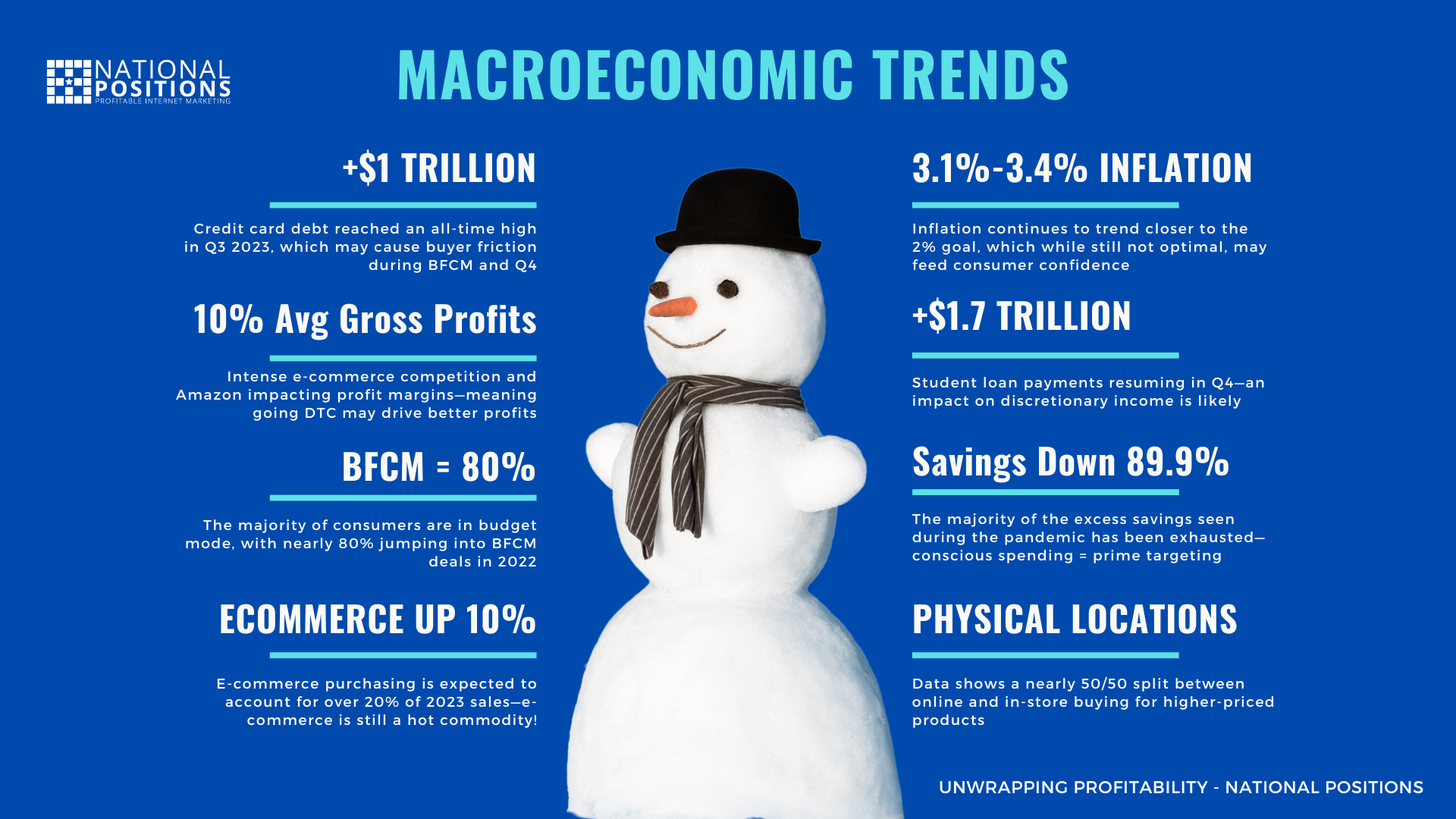

There is another reason for earlier holiday spending beyond the data that should not be overlooked. The amount of disposable income that e-commerce stores and retailers benefited from the past few years could be drying up. Why? The reinstatement of college loan payments.

In October 2023, student loan repayments will be starting up again, and those extra dollars may not be available for splurging on holiday gifts. With tens of millions preparing to start repayments, there is a high likelihood that holiday spending will need to be pared back—unless they are ready to bust out the credit card.

An estimated 43.6 million Americans hold federal student loan debts, owing an average of just north of $37,000 each. The economic pressure of millions of people needing to dedicate a portion of their spending to this $1.77 trillion debt is going to have ripple effects on retailers.

Record High Credit Card Debts

It was also just announced that credit card debts hit an all-time high of $1.03 trillion in the United States. This breaks out to roughly $5,700 of credit card debt for the average American. With these numbers being as high as they are, many Americans may be looking to curb their credit card purchasing during the holidays.

Pair this with another likely interest rate hike, and we foresee a tough outcome for brands that are banking on the holiday season in order to hit their 2023 revenue and profit goals. We are not trying to be the bearer of bad news—however, the combination of student loan repayments and swelling credit card debt is a reality that we can’t overlook.

Planning Now Is The Only Option

These numbers are a lot to take in all at once. We get it. But they’re critical. Every year we see too many incredible businesses assume they have enough time, and every year we hear horror stories about brands missing out on holiday profits. So waiting is not an option—especially this year.

Your campaigns for the 2023 holiday season must begin now to have a shot at meeting your project goals. You have the numbers, and you have heard about the uphill battle we will all likely be facing in Q4. Now it’s time to act.

Get Holiday Ready NOW!

If you want to dive deeper ASAP we highly recommend downloading a free copy of our Unwrapping Profitability ebook.

If you want to dive deeper ASAP we highly recommend downloading a free copy of our Unwrapping Profitability ebook.

You will receive a full plan for getting your BFCM and holiday marketing strategies on point and make this year a thriving (and profitable) success!

Contact our team of experts today to get your holiday strategies ready, be sure to let us know your most valuable channel you want to focus on for the season – and we will fast-track your request!